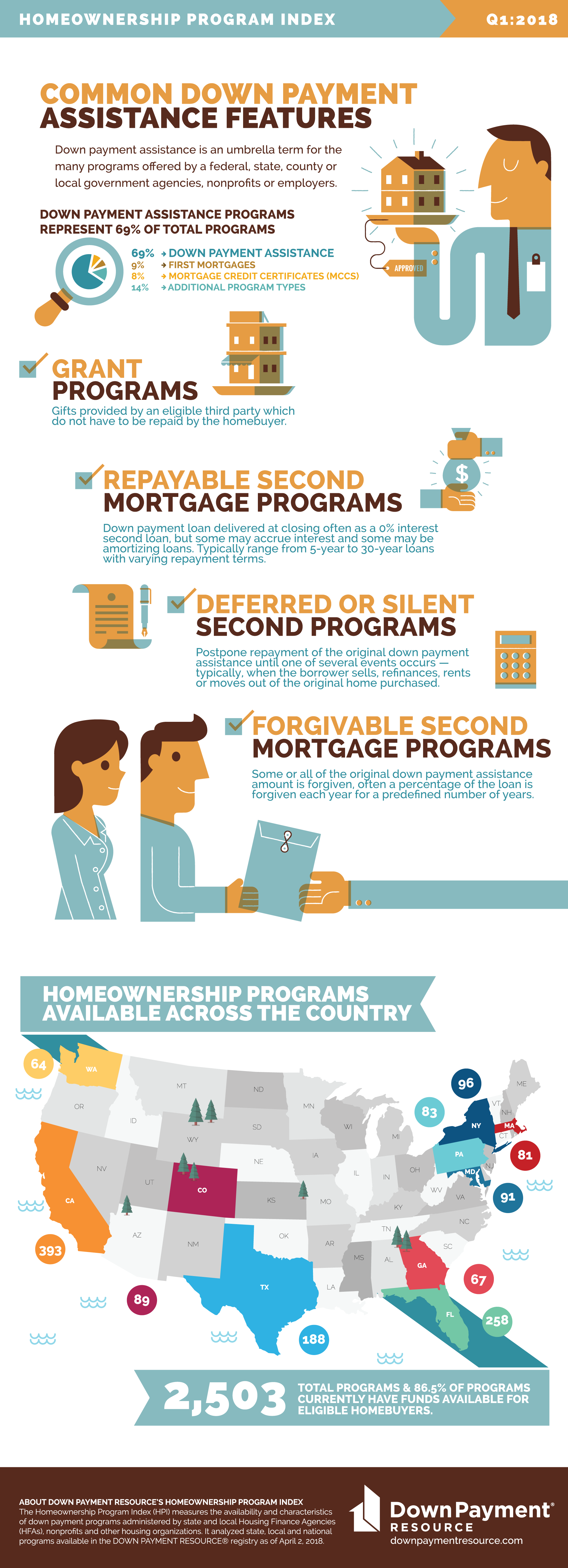

Down Payment Assistance programs, sometimes referred to as grants, can provide homebuyers with funds to cover up front and closing costs when buying a house. Borrowers will need to meet the eligibility requirements of the specific program they'd like to use. Credit scores, household income, family size, and homebuyer education requirements will likely be factors. It is common that first-time homebuyers can afford a monthly mortgage payment, but find it challenging to save enough money for down payment and closing costs.

Montana Housing down payment assistance programs can reduce the amount of up-front cash needed to purchase a home. Eligibility criteria include an unspecified minimum credit score and caps on your household income and home purchase price. You'll also need to put 1% of your own cash toward your home purchase. (The cost of your required homebuyer education course goes toward this 1%). It's possible to qualify for a mortgage from conventional lenders with a down payment as low as 3% of a home's final purchase price. FHA, VA and conventional loans require the manufactured home be secured to a base.

If the manufactured home is not secured to a base, you will need to apply for what's called a chattel loan. Research your local down payment assistance programs and see what their specific requirements are. From there, contact your lender to see if they work with these programs. Rocket Mortgage® does not offer financing on manufactured homes.

To obtain down payment assistance from Montana Housing, the borrower must first be eligible for aRegular Bond Program Loan. An approvedparticipating lenderwill qualify the buyer, determine how much down payment and closing cost assistance is needed and help the buyer select a Montana Housing home loan that is best. Some homebuyers may be able to borrow the entire minimum required down payment, plus all or a portion of the closing costs. Down payment assistance program funds are awarded to organizations throughout the state to create, continue and expand their existing down payment assistance programs. If you can't get pre-approved for a mortgage, you probably can't take advantage of a down payment assistance program.

You're going to need a steady job, a good income and better-than-average credit score to qualify for a mortgage. But if the only thing holding you back from buying a home is the down payment, you may be able to overcome that with a down payment assistance loan. Most down payment assistance programs are geared to first-time home buyers. The DSHA's Preferred Plus Program offers a second mortgage loan of up to 5% of your home's purchase price. You can put the money toward your down payment or closing costs. You'd need to repay the money when you sell the home, refinance, or stop using it as your primary residence.

There are lots of great reasons to consider a HomePath Home for your first home purchase, including low down payments and the HomeStyle renovation loan eligibility. This means that if you purchase a HomePath home for $200,000, you will get a credit for up to $6,000 in closing costs. Down Payment Assistance allows homebuyers to choose either 2.5% or 5% of the home's purchase price. Assistance can be applied towards down payments, closing costs or other pre-closing expenses. If you sell or refinance your home within seven years, you must repay all of the assistance provided. If you're in the market to purchase a home and need help with a down payment and closing costs, the Ohio Housing Finance Agency can help.

CHFA recognizes that saving enough money to pay the down payment is the main barrier to homeownership for many first-time homebuyers. While the FHA doesn't have a proprietary down payment assistance program, each state offers various down payment assistance programs for both first-time and low-income homebuyers. Borrowers obtaining an FHA loan are typically eligible for these programs. As part of the course, which you may be required to take to qualify for assistance, you'll learn about down payment assistance options. You can find homebuyer education programs by checking HUD's index of state and local housing programs.

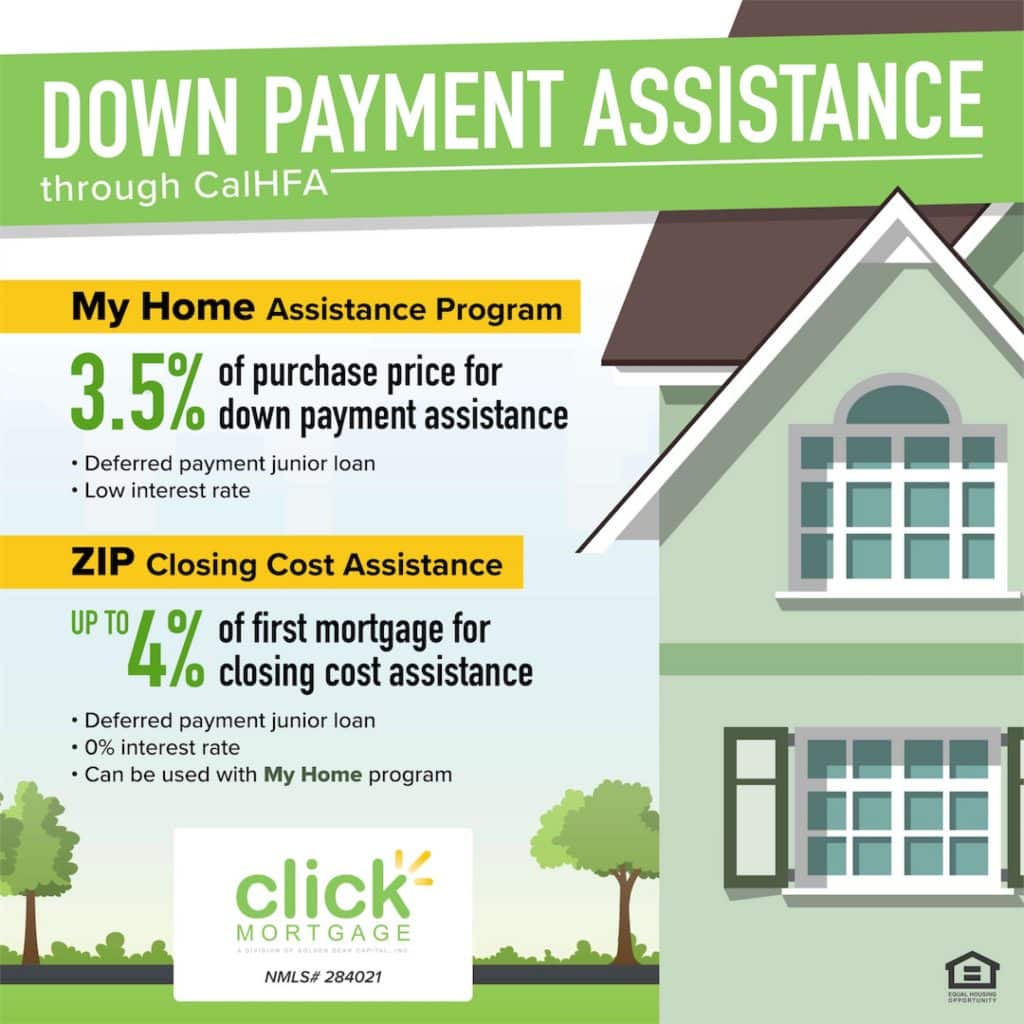

With this product, the borrower is able to lock the FHA first mortgage at market-comparable rate. The Rate Advantage product offers both 3.5% down payment assistance and 5% down payment assistance options. To qualify, you'll need a minimum credit score between 620 and 660, depending on the type of mortgage you choose.

And your household income and the purchase price of your home must be belowspecified limits. While an FHA loan may sound great, it's not for everybody. For those with bad credit, a personal loan may be a better option to consider. On the opposite end, aspiring homeowners who can afford a large down payment may be better off going with a conventional mortgage. It's more likely that they'll be able to save more money in the long run through the lower interest rates and mortgage insurance premiums that conventional lenders provide.

One catch to FHA loans is that borrowers are required to pay mortgage insurance premiums, or MIP, when they put less than 20 percent down. FHA loans are often a good fit for first-time homebuyers because down payments are lower, as are minimum credit scores, helping borrowers buy a home sooner. While the mortgages are insured by the federal government, the loans are obtained through mortgage lenders who are approved by the FHA. To qualify, you'll likely need a credit score of 640 or better. And your household income will be capped at amounts that vary according to family size and the county of purchase.

There are also limits on the purchase price of the home you're buying, most commonly up to $453,100. Some homebuyer programs explicitly say you can use their funds forclosing costsas well as your down payment. Check your local down payment assistance programs to see if closing cost grants are included.

The Arkansas Dream Down Payment Initiative provides lower income homebuyers in Arkansas, who qualify, up to 10% of the purchase price of their home, not to exceed $10,000. It is a second mortgage loan with no monthly payment that is forgivable over five years. The FHA Home Affordable Modification Program , for example, can help you avoid foreclosure by permanently lowering your monthly mortgage payment to an affordable level. Only certain homebuyers are eligible for down payment assistance. Eligibility varies by program, but requirements typically cover income, home price, creditworthiness, employment and an acceptable debt-to-income ratio.

These requirements are the same ones a mortgage lender will look for when deciding whether to extend a loan offer. Essentially, if you can get a mortgage pre-approval letter, but don't have a down payment, you can probably apply to one of these programs. There'sa list of those agencieson the OHCS's website, together with the county or counties each serves.

Also check outHUD's listof other homeownership assistance programs in the state. Other requirements might include income caps, purchase price caps, and buying a home in a qualified area. Many programs also require homebuyer education courses. Research what programs are available in your area, if any. Check with your city and county to see if they offer any loans or grant programs. Reach out to them via email or phone for specific answers you can't find online.

Loans insured by government agencies – such as VA or FHA loans – aren't technically examples of down payment assistance programs. However, these government-backed loans usually allow buyers to provide lower down payments, even with slightly shaky credit. This can be of help to first-time buyers worried about coming up with thousands of dollars at closing. Contact your local HUD office to learn more about the down payment and closing cost assistance available where you live.

The assistance funds come in the form of a zero-interest second mortgage with a 30-year term. This second mortgage will be forgiven if the borrower makes 36 consecutive, on-time payments on the first mortgage. This program works to help American Indian and Alaska Native people pursue their homeownership dreams. Section 184 borrowers can get into a home with a low down payment and flexible underwriting.

Section 184 loans can be used, both on and off native lands, for new construction, rehabilitation, purchase of an existing home, or refinance. HUD's website offers a map of approved areas by state and county as well as a list of eligible lenders. In order to secure the guarantee of the FHA, borrowers that qualify for an FHA loan are also required to purchase mortgage insurance, and premium payments are made to FHA. Your lender bears less risk because the FHA will pay a claim to the lender if you default on the loan. A Federal Housing Administration loan is a mortgage that is insured by the Federal Housing Administration and issued by an FHA-approved lender.

FHA loans are designed for low-to-moderate-income borrowers; they require a lower minimum down payment and lower credit scores than many conventional loans. Down payment assistance programs are widely available, and they are easier to qualify for than you might think. For a sizable number of people who have good jobs, steady income and decent credit but lack the cash for a down payment, they provide a viable route to homeownership. Down payment assistance programs are initiatives sponsored by federal, state and local governments, as well as private nonprofit organizations. They offer loans, including no-interest and even forgivable loans.

These groups also offer grants to would-be homeowners who need a little help. CBC Mortgage Agency has a mission to increase affordable and sustainable homeownership, specifically for creditworthy, low- to moderate-income individuals. CBC Mortgage Agency partners with reputable mortgage lenders on a correspondent basis to provide loans for qualified homebuyers. Louisiana has one of the most generous down payment assistance programs. Qualified borrowers could get 20% of a home's purchase price — up to $55,000 — as a silent second mortgage.

This down payment assistance comes in the form of a second mortgage loan that must be repaid via monthly payments. The best way to find down payment assistance programs for which you qualify is to speak with your loan officer. They will likely know about local grants and loan programs that can help you out. They'll also know which programs the lender can accept . Matched savings programs, otherwise known as individual development accounts, are another way for homeowners to help pay for their down payments. In such programs, homebuyers deposit money into an account with a bank, government agency or community organization.

That institution agrees to match however much the buyers deposit. Buyers can then use the total amount of funds to help cover their down payments. The down payment is the out-of-pocket investment you make when you buy your property.

The required amount is generally calculated as a percentage of the purchase price, determined by the requirements of the loan. This upfront payment is essentially seen as your investment in the mortgage, since you stand to lose it if you're unable to meet your monthly payment obligations. The DPAL may not exceed the total amount needed for the down payment, closing costs and prepaid expenses (after applying borrower's minimum contribution).

The FHA insures mortgages issued through private lenders. FHA loans are very popular among first-time home buyers since they typically require lower minimum credit scores and down payments than conventional loans. At the completion of an approved homeowner education program, Fannie Mae will give the future homeowner a credit for up to 3% of the HomePath home's purchase price as a closing cost credit. Our Down Payment Grant program offers a grant equaling 3% of the home purchase price, up to $10,000, to be used for a down payment in select markets. Grant Program is currently limited to two specific mortgage products.

Qualified buyers are required to complete free homebuyer education. OHFA's streamlined education program allows you to complete a course offered by any U.S. Department of Housing and Urban Development -approved counseling agency in Ohio. Please note, OHFA homebuyer education is not completed until after homebuyer has submitted their loan application with their loan officer.

Homebuyer Education is not required for borrowers who are only registered for our MTC Basic program. If you are eligible for our programs, TSAHC will provide you with a mortgage loan and funding to use for your down payment. You can choose to receive the down payment assistance as a grant or a deferred forgivable second lien loan . If you're eligible, you can essentially receive free money to help you buy a home.

Visit the website of the local government agency or organization administering the program to learn about down payment assistance requirements and to get a list of approved mortgage lenders. Often programs require first-time homebuyers to take homebuyer education courses. In Texas, for instance, the Department of Housing and Community Affairshas a state-sponsored course. The free, two-hour online course walks a potential homebuyer through the process and issues a certificate of completion. Many homebuyer assistance programs want first-time homebuyer applicants to have similar certificates.

These programs offer to help homebuyers come up with some or all of the down payment and, in some cases, closing costs. The borrower may choose a 10-year repayable second at a 0% interest rate (0% APR) or a 30-year repayable second at a 5% interest rate (5.009% APR). The borrower will need to meet the minimum credit score of 600.

This product offers both 3.5% down payment assistance and 5% down payment assistance options. And readHUD's listof other homeownership assistance programs available in West Virginia. View the listof DPAs on WSHFC's website and click through for details of each program. And consultHUD's listof other homeownership assistance programs in the state. Find out more about these down payment assistance grants on theVHDA website.

And readHUD's listof other homeownership assistance programs in the state. And exploreHUD's listof other homeownership assistance programs in Utah. Find more details about the program here, or seeHUD's listof other homeownership assistance programs in Texas. For more details you must contact one of thelenders that participate in the program. Also check outHUD's listof other homeownership assistance programs operating in South Carolina.

The program has lots of options and rules, so read up on the details atNeighborWorks Montana's website. And checkHUD's listof other homeownership assistance programs in the state. All programs have income limits and price caps on eligible homes. No help is available for those buying in Pima County, and only certain mortgages are eligible in Maricopa County.